COVID-19 (Temporary Measures) Act 2020: What Does it Mean for PHV Drivers?

Many private hire (PHV) drivers are feeling the financial effects of COVID-19 due to the implementation of the Circuit Breaker measures in Singapore. As most of the country’s workforce is working from home, fewer people are outside. This has caused a sharp decline in business, affecting the income of many drivers.

In response to this, the government introduced support measures like the COVID-19 (Temporary Measures) Act 2020 to ease the financial burden put on these drivers through a set of relief measures.

These measures have a direct impact on PHV drivers and aim to ease their cash flow concerns. If PHV drivers need help with their car payment, they have an option to defer the monthly repayment of their hire-purchase or conditional sales agreements for commercial vehicles for a prescribed period of 6 months, from 20 Apr to 19 Oct.

During this period, the financing company will not be able to:

- Repossess their commercial vehicles

- Begin or continue court or insolvency proceedings against them

To qualify for this Relief, drivers must meet these terms of the Act:

- Entered into the contract before 25 March 2020

- Unable to pay instalments from 1 February 2020 or later due to COVID-19

- The vehicle is not rented

- The vehicle is not purchased for personal use

- Not have unpaid instalments before 1 February 2020, or if the vehicle was repossessed before 20 April 2020

What you didn’t know about the Relief measures

While the relief measures may seem quite beneficial for PHV drivers, the measures come with hidden implications that you might not be aware of.

So, it’s crucial that you read between the lines and fully understand the long term impact these measures would have on you and not let the short term benefits overshadow your decision-making.

-

The Relief does not waive off late charge fees and interests

While you will be protected from legalities if you miss your monthly repayment with this Relief, you are still liable to late charge fees, late payment interests and additional charges at the discretion of the finance company or bank.

-

Your outstanding loan amount will be higher

Even though your monthly repayments have been deferred, the applicable interests, charges and instalments still need to be paid at the end of the prescribed period.

So, taking this Relief will actually increase your overall outstanding loan amount. This means that your remaining instalments will also be higher.

-

The initial interest rates will change

Hire purchase interests are generally fixed and calculated on a flat rate basis for the loan period, as agreed in the contract. Therefore, any deferment or lengthening of the loan period will result in further interest charges and fees (where applicable).

-

Your loan tenure might not be extended

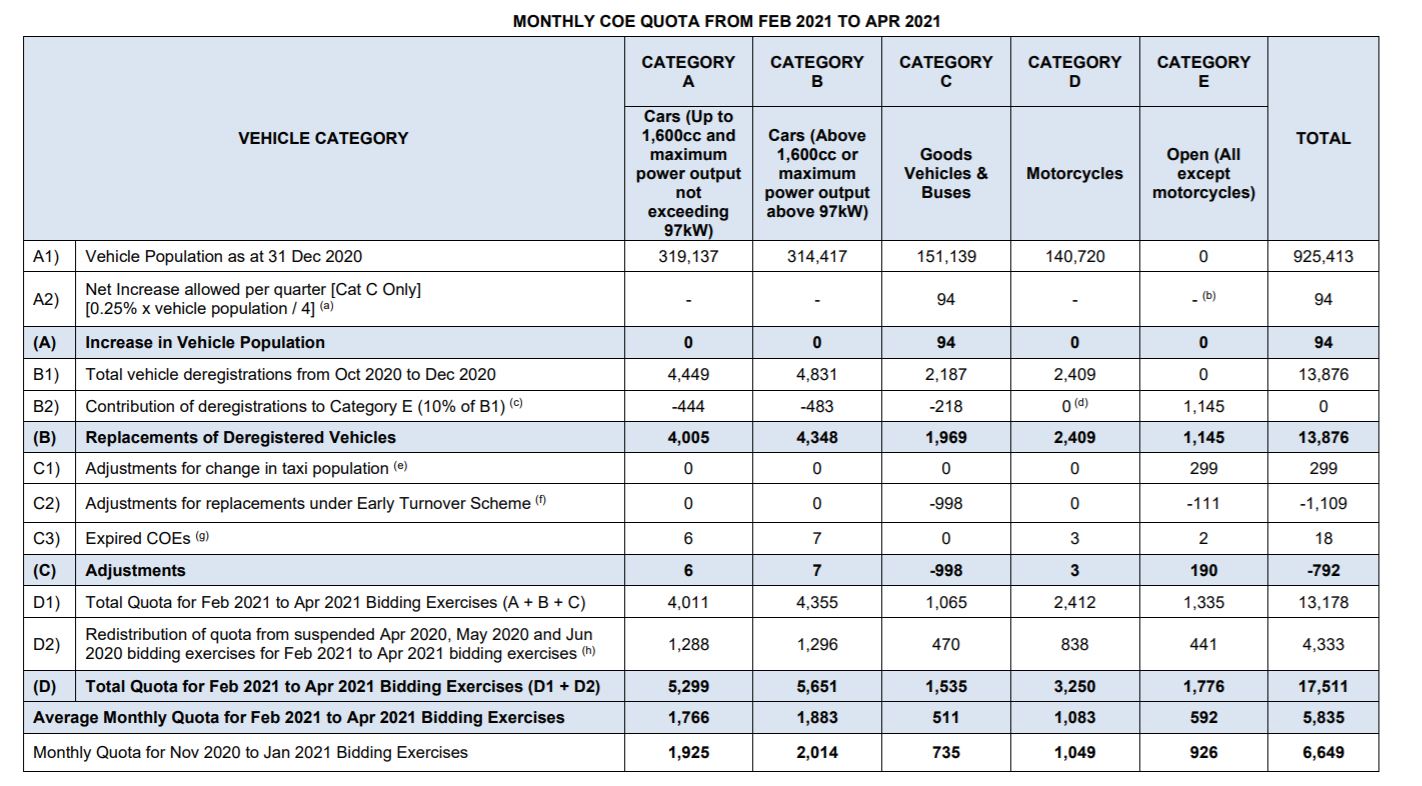

In most cases, your original loan tenure will coincide with your COE validity period. Therefore, deferring payments might not mean you get to postpone your repayment by the prescribed period of up to 6 months as there is no further room for extension.

It’s entirely possible that you might need to pay the deferred amount in a lump sum at the end of the deferment period.

-

The Relief does not start automatically

Before skipping any instalments, you must first check to see if you qualify for the relief. If you qualify, you and your guarantor/surety should then serve the finance company with the Notification for Relief.

Even then, the finance company has to agree that the relief applies. So, the process can take some time. Between getting an agreement from the company and when you applied, you must continue paying your instalments. Otherwise, you will be subjected to late payment and/or additional interest charges.

Learn more about these measures at MOL’s FAQs for Hire-purchase Agreement.

What you should consider before applying

After learning about these potential implications, what should you do?

First and foremost, ask yourself, is the deferment really necessary for you? Remember that the Relief is meant as a temporary measure and will only be beneficial for the short term. In the long run, the implications could hurt you even more.

But don’t only consider the long term impact taking this relief will have on you, you should also take into account the long term economic impact of COVID-19 as a whole.

With recession looming and uncertainty on how long it will take for us to recover, tough times are ahead. So, increasing your debt in these uncertain times is definitely not a wise thing to do. You don’t want to put yourself in a worse position in 6 months time, right?

Therefore our recommendations are for you to first consider alternative measures before locking in on a deferment.

Some alternative steps you can take right now include:

- Discuss with your finance company on a partial repayment scheme

- Relook at your finances to see what you can cut back on to meet these payments

- Compare the value of deferment of your other loans instead

- I.e. HDB loans have a lower interest rate and property value will appreciate over time, therefore would be a better and cheaper option for you to defer

- Utilise the relief packages offered for PHV drivers, such as the PPSP launched by the Ministry of Transport

If you really can’t afford to keep up with the monthly payments, you should consider selling your vehicle. Remember that cars in Singapore depreciate every day. So, keeping hold of your car is actually a liability as you’ll be losing more and more money over time.

At the end of the day, the important thing to remember is that this Act does not remove or absolve hirers’ contractual obligations with their financier, but seeks to temporarily prohibit enforcement of the contract during the relief period. The unpaid instalments and any other charges such as interest or fees for late payment will continue to pile on during the relief period.

People also liked: POST CIRCUIT BREAKER: HOW TO SELL YOUR CAR SAFELY A COMPLETE GUIDE TO DISINFECT YOUR CAR 5 THINGS TO DO EVERY TIME YOU DRIVE DURING CIRCUIT BREAKER