Car Tax Structure and Rebates

There are two key things that contribute to the high cost of car ownership in Singapore. Everyone’s favorite Certificate of Entitlement (COE) premiums and a really confusing car tax structure. When you add up the COE and taxes, it can cost you almost two to three times more than the Open Market Value (OMV) of your car. With all these additional taxes and rebates, it can get really confusing and you might not know what you’re paying for.

To help you understand all the taxes and rebates surrounding buying a brand new car, check out the breakdown of all the terms below.

Car Tax Structure and Rebates

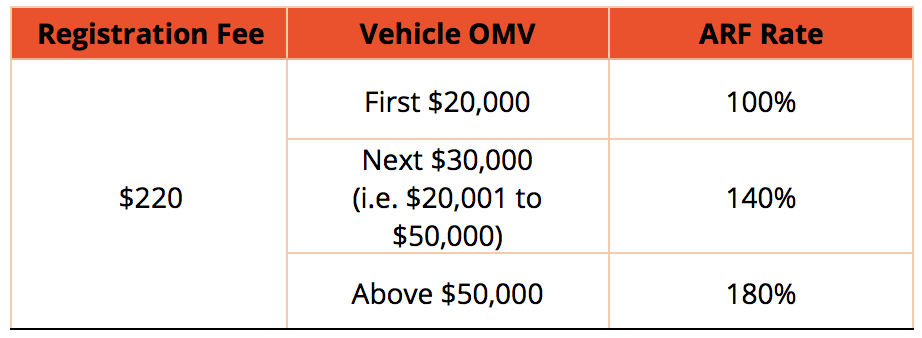

All brand new cars registered in Singapore are subjected to Government taxes and in some cases, rebates. The first two car taxes that you’ll have to pay is the Registration Fee (RF) and the Additional Registration Fee (ARF). While the RF is a standard $220 across the board, the ARF is determined by the OMV of a vehicle and calculated in a tiered system.

*Basically, the OMV is the actual price of the car before applying all the additional taxes and surcharges.

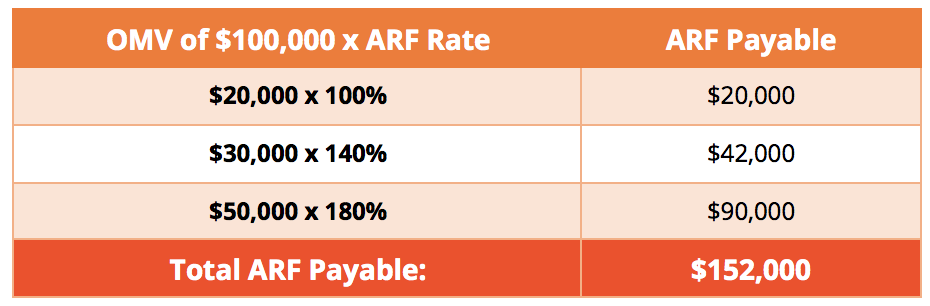

If you still don’t understand, here’s an example of how the ARF is calculated based on a car with an OMV of $100,000:

The calculation is pretty simple but as you can see, the payable ARF is a lot. But don’t worry, you can offset the ARF payable if you drive an ‘eco-friendly’ car through the Vehicular Emissions Scheme (VES).

VES vs CEVS

As of 1 January 2018, the Vehicular Emissions Scheme (VES) will take over the Carbon Emissions-Based Vehicular Scheme (CEVS). Essentially, the difference between CEVS and VES is that the VES takes into consideration more pollutants when banding vehicles.

Read more about the difference between the CEVS and VES here.

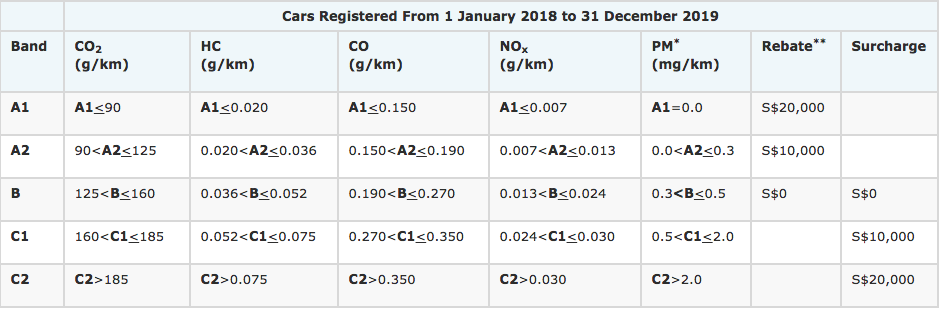

Essentially, the VES takes into consideration a total of five pollutants. They are Carbon Dioxide, Hydrocarbons, Carbon Monoxide, Nitrogen Oxides and Particulate Matter.

With the VES, you will either be charged a fee or given a rebate. It all depends on the banding your car falls under.

Therefore, having a car that falls under the A1 or A2 band will help you save a lot more (up to $10,000). And cars in the C1 and C2 banding will incur additional charges(up to $10,000).

Understanding the VES can help you decide on the ideal car for you and your budget.

Road Tax

While there are many different forms of road taxes, the most common form is Electronic Road Pricing (ERP) gantries found in almost every corner of the country. The idea behind the ERP system was to control the flow of cars in and out of areas that experience high traffic.

While it might not seem as much when you calculate how much each person pays on average, the total amount of taxes the ERP collects amount to about $150 million annually.

That’s pretty insane!

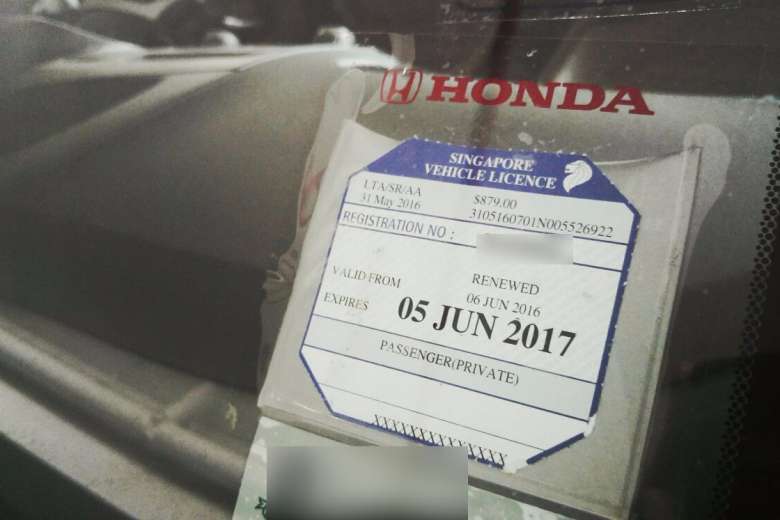

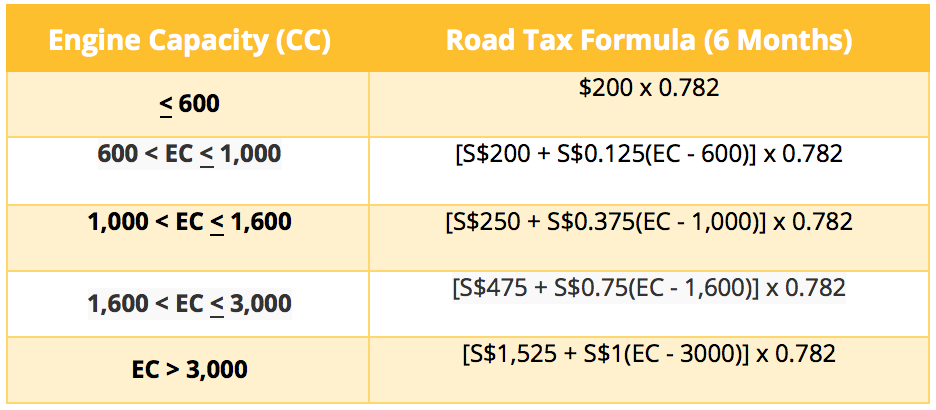

Another form of duty is the Road Tax. This Road Tax requires drivers to renew it every six months or every year. The amount varies and is usually dependent on the vehicle’s specifications.

Calculating Road Tax

Here’s an example of a car with engine capacity (EC) of 1,600cc:

| Road Tax | = [S$250 + S$0.375 (1,600 – 1,000)] x 0.782 |

| = [S$250 + S$0.375 (600)] x 0.782 | |

| = [S$250 + S$225] x 0.782 | |

| = S$475 x 0.782 | |

| = S$372 |

Therefore, the Road Tax is S$372 (for 6 months) or S$744 (for 12 months).

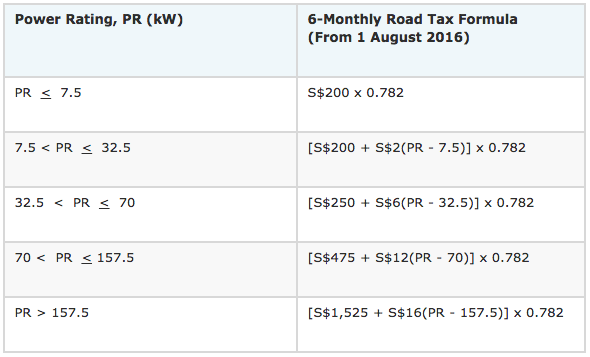

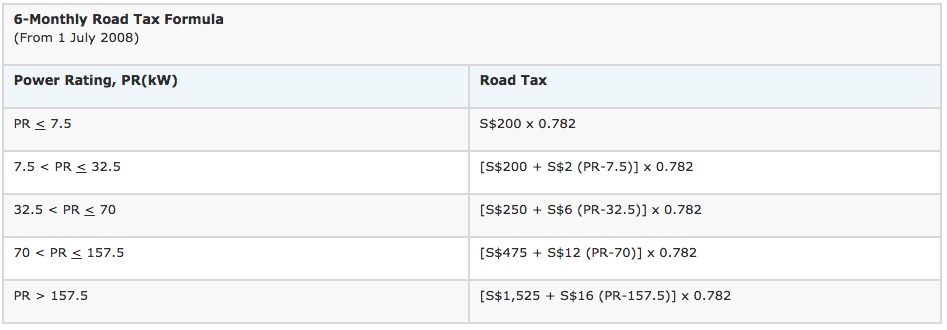

The calculation of Road Tax is different for Petrol-electric and fully-electric cars. For Petrol-Electric cars, the Road Tax payable is based on the engine capacity or maximum power ratings, whichever is higher.

The Road Tax for Fully-electric cars are usually the lowest and is calculated based on the maximum power rating.

If you’re still confused, you can find out how much your Road Tax is here.

Additionally, there are prerequisites to fulfill before you can renew your road tax, like an inspection by the authorities.

You can find more information on the prerequisites for Road Tax renewal here.

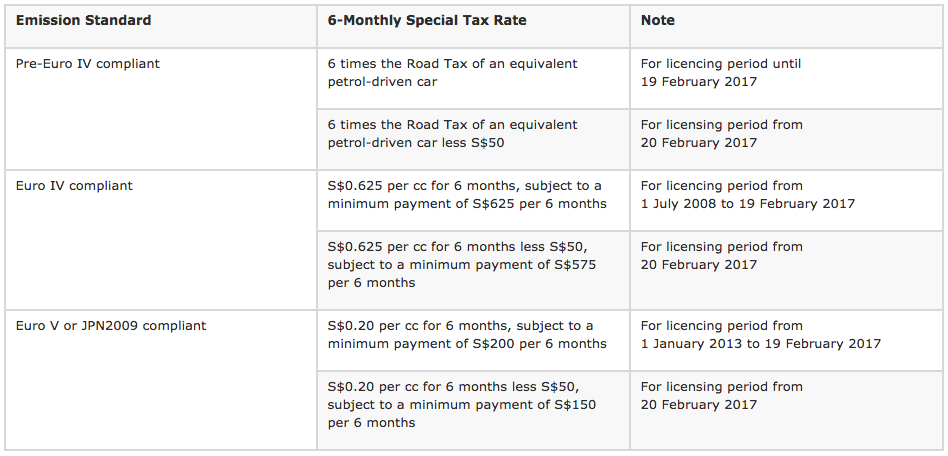

Special Car Tax

If you own a diesel car, you’ll need to pay a Special Tax on top of your Road Tax. The cost of these taxes differs based on the European Emissions Standards that your car falls under.

The Special Tax aims to encourage fuel conservation and discourage excessive use of vehicles that contribute to pollution.

That’s all the car taxes and rebates that surround car ownership in Singapore.

People also liked: ROAD TAX RENEWAL & MORE HOW TO SCRAP YOUR CAR IN SINGAPORE THE COST OF OWNING A CAR IN SINGAPORE