Private Hire Vehicle (PHV) driver – To own or to rent?

As a PHV driver in Singapore, you’re constantly weighing the cost of renting against the long-term benefits of car ownership. But what if owning a car was just as affordable as renting?

For many Singapore PHV drivers, choosing between renting and owning a vehicle is more than just a financial decision—it’s a lifestyle choice that can shape one’s career for years to come. Let’s explore the pros and cons of both options and take a closer look at the math to determine which is best.

Renting and leasing: Flexibility and low upfront commitment

Advantages:

- Flexibility

Renting offers drivers the freedom to switch vehicles or upgrade as needed, a perfect fit for those with fluctuating ride-hailing demands. - Lower Initial Cost

With minimal deposit requirements and bundled packages that often include maintenance, insurance, and servicing, renting minimizes the need for a large upfront investment. - Hassle-Free Maintenance

Rental schemes frequently cover repairs and regular upkeep, allowing drivers to focus on their work rather than worrying about unexpected vehicle expenses.

Considerations:

- Recurring Costs

Although the monthly car rental fees may appear affordable, over time these payments add up, with no equity built in. - Limited Customization

Renting a vehicle typically means you’re using a fleet car, which might not reflect your personal preferences or branding as a driver.

Owning: Long-term investment and independence

Advantages:

- Building Equity

Car ownership means every payment contributes to a long-term asset. Over time, you have the opportunity to build equity and eventually own your vehicle outright. - Personalization

When you own your vehicle, you can tailor it to your specific needs—whether it’s for comfort, performance, or even branding purposes that might enhance your service. - Financial Control

Owning your car often leads to more predictable long-term expenses, freeing you from the cycle of continual rental payments and car servicing fees.

Considerations:

- High Initial Investment

Traditionally, purchasing a vehicle comes with a steep down payment and financial hurdles that can deter many drivers from making the leap into car ownership. - Longer Commitment

Financing a new car typically means a longer-term loan commitment, which requires careful budgeting and financial planning.

The cost of owning vs renting

|

Carro New Cars |

Company A – Car ownership scheme |

Company B |

Company C |

||

|

Long-term car leasing |

PHD Vehicle scheme |

||||

| Cost per day | $57.43 | $102 | $76 | $73 | $75 |

| Downpayment | $0 | $5,450 | $0 | $0 | $0 |

| Tenure | 10-year loan (PHV exclusive) | 6-year scheme | 2-year lease | Daily rental | Daily rental |

| Ownership | Yes (Car is yours after loan) | Yes (after 6 years) | No (lease) | No (rental) | No (rental) |

Figures taken from different e-hailing companies operating in Singapore.

The game changer: Carro’s new car program for PHV drivers

Enter Carro’s innovative new car program—a solution designed specifically for Singapore’s PHV drivers. This program is redefining what it means to own a vehicle by addressing the primary barrier that many drivers face: the initial cost.

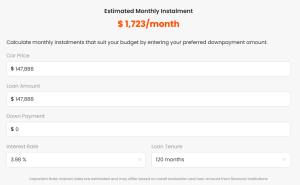

- Zero Down Payment

Carro New Cars cater exclusively to PHV drivers and eliminates the need for a hefty upfront deposit. This means you can step into a brand-new car without having to fork out a large sum of money first. - 10-Year Loan

With an extended repayment period, drivers can enjoy manageable monthly payments spread out over 10 years. This long-term plan is tailored to fit the financial flow of PHV drivers, offering stability and predictability. - Exclusivity for PHV Drivers

Understanding the unique needs of the ride-hailing industry, Carro’s program is exclusive to PHV drivers. This ensures that the financing options are designed with your work dynamics in mind, making the transition from rental to ownership smoother than ever.

Connect with us today via Carro New Cars.

By removing the traditional financial barriers, Carro’s New Car program paves the way for drivers to build their own asset while still focusing on growing their business. It’s an attractive option for those who aspire to move from a cycle of renting to a future of full ownership.

Carro New Cars – The most affordable path to ownership for PHV drivers

Carro’s zero down payment plan lets PHV drivers own a car with a 10-year loan and daily costs as low as $57.43. This is the most affordable and cheapest option and ensures drivers build equity instead of paying rent forever. While maintenance and insurance aren’t included, owning the car long-term makes this a smart financial choice for serious drivers.

Making the right choice as a PHV driver

Deciding whether to rent or own your PHV is a professional as well as a very personal decision that hinges on your current financial situation, long-term career goals, and lifestyle preferences.

Renting provides flexibility and lower risk that might suit drivers who value immediate ease and minimal commitment.

Owning a vehicle means investing in your future—gaining independence, building equity, and having the freedom to customize your own driving experience.

With innovative financing options like Carro’s new car program—featuring zero down payment and a 10-year loan exclusively for PHV drivers—the ownership route has become more accessible than ever. It’s an ideal solution for those ready to transform their ride-hailing career from a temporary setup into a lasting and long-term investment.

Ready to make the switch? Explore Carro’s PHV-exclusive ownership program today and drive with confidence!