How to Fix: “This vehicle has insufficient/no insurance coverage” Error

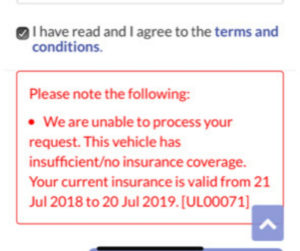

When trying to renew your road tax online, you might’ve experienced certain errors along the way. One that pops up quite a few times is this: “We are unable to process your request. This vehicle has insufficient/no insurance coverage”.

Every time this error appears, we have no clue why it does and how to solve it. It can be really irritating, especially when all you want to do is renew your road tax.

So how do you fix this issue?

Many times, you’ll probably wing it with some trial and error – refreshing the page, keying the details again and whatever else we can think of.

Most of the time, this doesn’t work.

This vehicle has insufficient/no insurance coverage error

The cause for this is most likely due to the misalignment of start dates for your road tax and car insurance.

Due to this misalignment, it will eventually lead to you facing some inconvenience, even preventing you from renewing your road tax.

It’s important to note that the error is common for secondhand cars. Most of the time, the date which the previous owner renewed their road tax and the date that the ownership was transferred to you is different – which causes this error to appear.

If you happen to face this error, you should try to get it fixed as soon as possible. Don’t sit on the issue for too long as it might cause you to renew your road tax late. And as you know, renewing your road tax late will incur a late penalty fee.

How to fix?

There are 2 routes to go about fixing this issue. But both require you to sync up your road tax and car insurance renewal dates.

You can either extend your insurance coverage (pro-rated) to sync up to your road tax renewal date. Or extend your road tax, aligning it to your insurance expiry date.

For example, if your road tax expires in July 2019 and your insurance expires in January 2020, you will need to sync up these 2 dates.

Which route you take will depend on certain things. Namely the duration between the renewal dates.

If the difference is more than 3 months, we suggest you renew your insurance plan for a year. Why? Taking up a pro-rated insurance extension of more than 3 months is not worth it as you will be missing out on the no-claim discount (NCD). The NCD doesn’t apply if your insurance policy is less than a year.

Additionally, if you happen to find a better offer from an insurer, you can consider jumping ship. Cancel the current policy up till the road tax renewal date (if that’s an option) and take up the new policy. But of course, do your calculations on the cancellation refund and savings on the premiums before signing anything!

Looking to renew your insurance? Check out Genie Financial Services’ comprehensive list of trusted insurers! Enjoy a quick and hassle-free digital experience that guarantees you the best deals for your car insurance.

People also liked: ROAD TAX RENEWAL & MORE WHAT’S THE DIFFERENCE BETWEEN LEASING AND CAR SUBSCRIPTION? 10 THINGS YOU MUST KNOW BEFORE YOU RENEW YOUR COE