What is Motor Insurance Fraud?

Motor insurance fraud is the act of deceiving insurers into paying out for damages or injury by faking or setting up traffic accidents.

The number of fraudulent accidents have been on the rise in Singapore. Motor insurance fraud has been quietly taking root and growing in Singapore over the years.

The Commercial Affairs Department (CAD) of the Singapore Police Force (SPF) states that the number of sham accidents reported doubled from 13 in 2016 to 26 as of September 2017.

Likewise, Prosecution figures have also went up. 66 people were charged for motor insurance fraud in 2016, a near 40 per cent increase from 2014, where 48 people were charged.

Who is Behind Motor Insurance Fraud?

Officers from CAD’s insurance and specialised fraud branch revealed that large-scale syndicates are behind the majority of motor insurance fraud cases. Head of branch Superintendent of Police Abdul Rani Abdul Sani also added that there have been at least 5 major syndicates in the past 5 or 6 years.

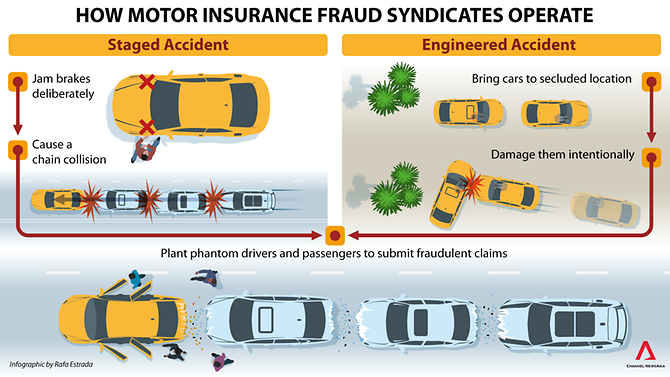

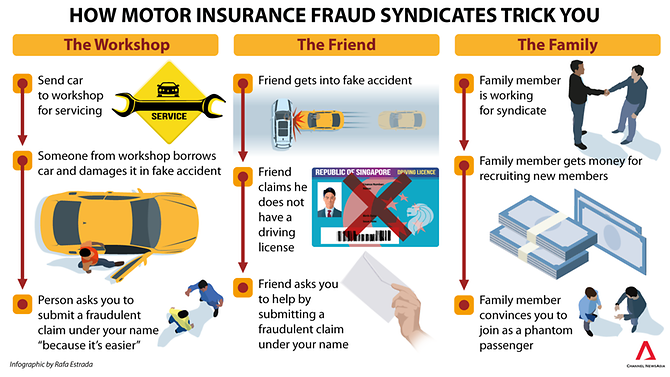

The multi-layered and far-reaching nature of these syndicates are what enables them to stage accidents while being difficult to detect. The syndicates are highly organised and have roles within the organisation like masterminds, recruiters, stunt drivers and even phantom passengers. Some syndicates cooperate with workshops to overcharge customers to collect referral fees. In some cases, foreigners and foreign-registered vehicles are also involved.

How it Works

Due to the nature of the fraud and having to avoid detection, syndicates constantly need to recruit more phantom passengers and drivers to avoid submitting multiple claims under the same identity.

Recruitment for these syndicates are similar to how multi-level marketing or pyramid schemes operate. A recruit gets his friends involved, those guys then get their friends involved.

According to Inspector Kumarasamy, phantom drivers stand to earn about S$500 per claim and an additional S$200 for each phantom passenger recruited. In fact, some might not even be aware that they are participating in motor insurance fraud. It is not uncommon for unknowing participants to think that they’re simply helping a friend out.

The constant cycle of recruitment keeps the syndicate’s web growing and makes it more difficult to detect and take down the heart of the organization.

The Impact of Motor Insurance Fraud

Statistics provided by General Insurance Association (GIA) show that roughly 160,000 accidents were reported in 2016 – about S$500 million worth of claims.

Commonly sustained injuries in collisions such as whiplash are easy to fake and difficult to challenge. Insurance companies are practically forced to payout even if there are suspicions of false claims.

An estimated 20% of motor claims are either fraudulent or inflated, meaning that roughly S$99 million was lost to fraud. Insurance companies do lose out but ultimately the costs are ultimately borne by motorists in the form of higher insurance premiums. The general public are the true victims.

Challenges of Taking Down Motor Insurance Fraud

As stated earlier, the multiple and complex layers of the syndicates make them difficult to detect and take down, especially when there are multiple different operations run by different parties within the organisation.

Collecting evidence and building a case is also a gargantuan challenge due to the scale of the fraudulent operations and the sheer amount of people involved.

In a previous case reported in December 2015, over 100 people were interviewed in the 2-year process of taking down a syndicate.

Combating Motor Insurance Fraud

CAD works with GIA and insurers discussing new trends and issues in order to improve the situation to prevent or deter motor insurance fraud.

A GIA spokesperson also said that insurance companies are setting up their own special unit to investigate fraud. The role of the unit is to detect and investigate suspicious claims in detail and pursuing action against fraudulent activities, reporting to the CAD if necessary.

Additionally, the GIA has an anti-fraud hotline and a fraud management system that uses data and analytics to track suspicious claims to aid in fraud handling processes.

Protecting Against Motor Insurance Fraud

While the authorities and insurance companies are stepping up efforts to fight fraud, the public also has a part to play.

Drivers can protect themselves by using dashboard cameras or dashcams. Dashcams are widely available at different price points to suit different needs and budget. Having dashcam footage available will help in all accident situations, staged or otherwise. Dashcam footage can help you in challenging fraudulent claims, or by providing the authorities with video evidence in the case of a staged accident. In this day and age, all drivers should equip their cars with a dashcam.

Secondly, individuals should not, under any circumstances submit a claim for an incident they were not involved in.

Thirdly, drivers should only use workshops approved by or pre-approved with their insurance provider. In some cases, touted workshops are actually in cahoots with the syndicates running the fraud. They then overcharge unsuspecting victims to collect referral fees. It’s best to stick to a workshop you know and trust.

Lastly, individuals can report suspicious fraud-related activity via the GIA hotline (1800–44–37283 or GI-FRAUD).

Original Article from Channel News Asia.