Insurance Guide: Calculation of Premium

For first-time car owners, getting insurance for your car is the next most difficult thing after buying the car. Car Insurance, like any other insurance, varies across a wide range of prices and package types. The basic concept of the price of insurance is that the higher the risk exposure to the higher the premium you need to pay. Here’s our Car Insurance for Beginners Guide – Calculation of Premium.

Calculation of Premium

Premium is the price you have to pay monthly, annually, or according to the agreed duration. The premium for car Insurance varies due to many factors. Listed below are the typical ways in which insurance premium is usually calculated.

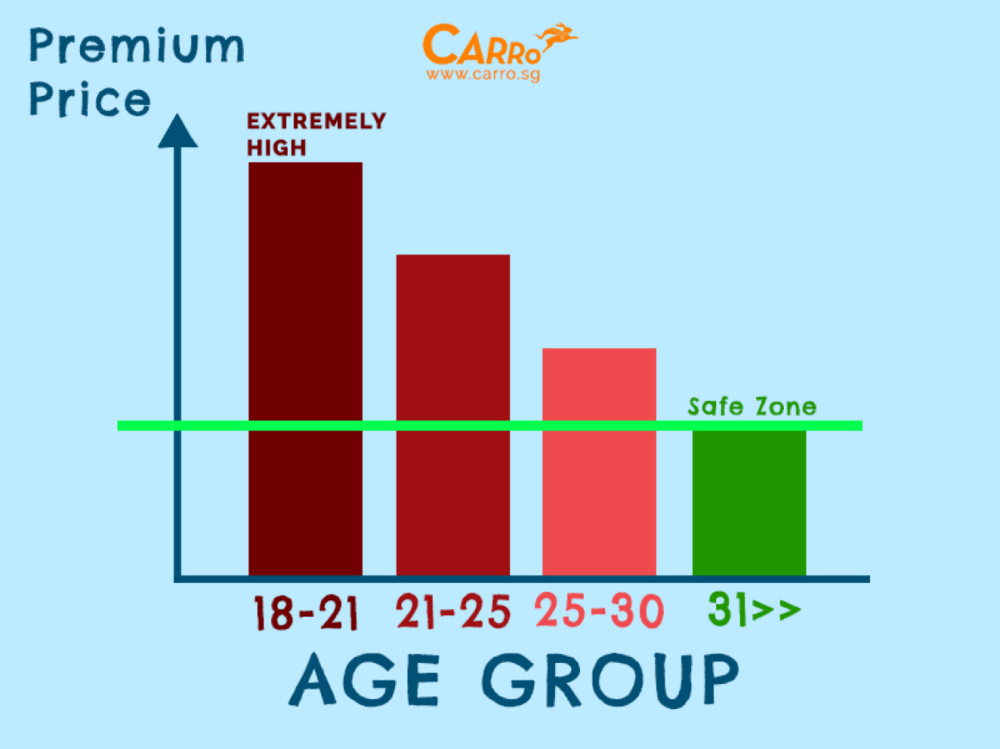

1. Age Group

Insurance companies would consider your age as one of the main considerations. According to database statistics conducted by most insurance companies, the age group you are in correlates to the possibility of you getting into an accident.

2. Driving Experience

This depends on the time span from the time you got your driver’s license to the time you are buying your insurance. Most insurance companies assume that the more experience you are in driving, the better you are in controlling your car, thus, the lower the possibility of getting into an accident.

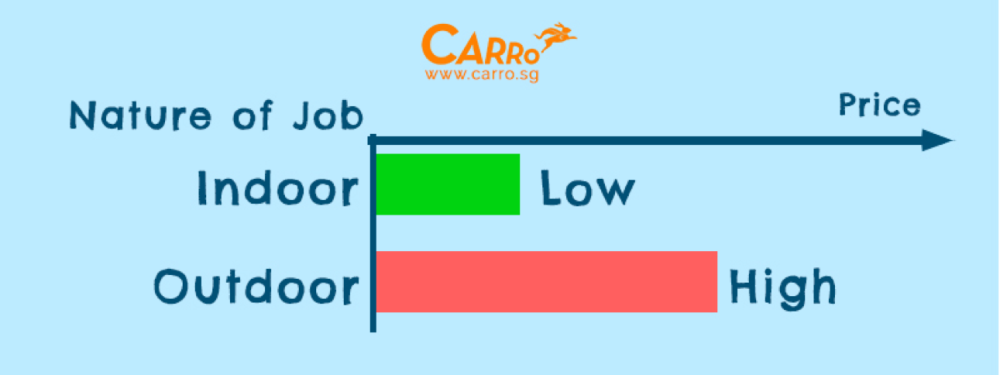

3. Job Nature (Indoor/Outdoor)

This basically measures how much time you might spend on the road according to the Insurance Company’s point of view. Job requirements that require you to drive more

Would increase the risk of getting into a road accident. The higher the risk, the higher the premium you would be charged.

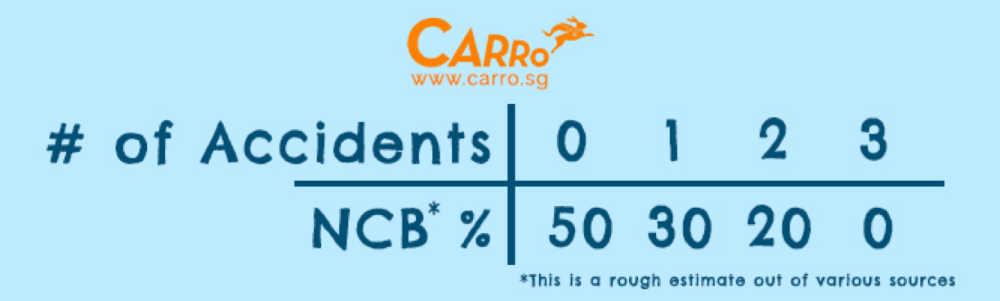

4. No Claim Bonus (NCB)/No Claim (NC) Discount

This might be a new concept for first-time insurance holder. As a reward for an accident- free year, the insurance company can offer you some discount for your insurance the following year. This would mean that you will pay a cheaper premium for the subsequent year. You can accumulate more discount if, for the subsequent years, you remain accident-free and have no need to claim insurance. For most insurance companies, you will earn 10% of NCB every year with a cap of 50%. Which means, every year you would have your premium reduced, making your insurance premium to be cheaper year after year.

This is calculated using the method below:

Hence, this shows that if the higher your NCB, the lower your premium for a specific year.

p.s.: Do not be attracted with high NCB alone, there might be hidden terms and conditions that prevent you from claiming in the case of an accident after you gain your NCB.

5. NCB Protector

This is a scheme where NCB will be reduced for every accident until it reaches 0%. When NCB reaches 0%, it means that you have no discount for your yearly premium for the next year. Meaning you will have to pay the agreed premium for the year onwards.

6. Safe Driver Discount

Safe Driver means that you have a clean accident history, no traffic offence or demerit points for the past 2 years. This is basically a discount on top of the NCB you have (only applicable for insurance holders that have NCB of 30% or less). This will enable you to get more discount on your annual insurance premium.

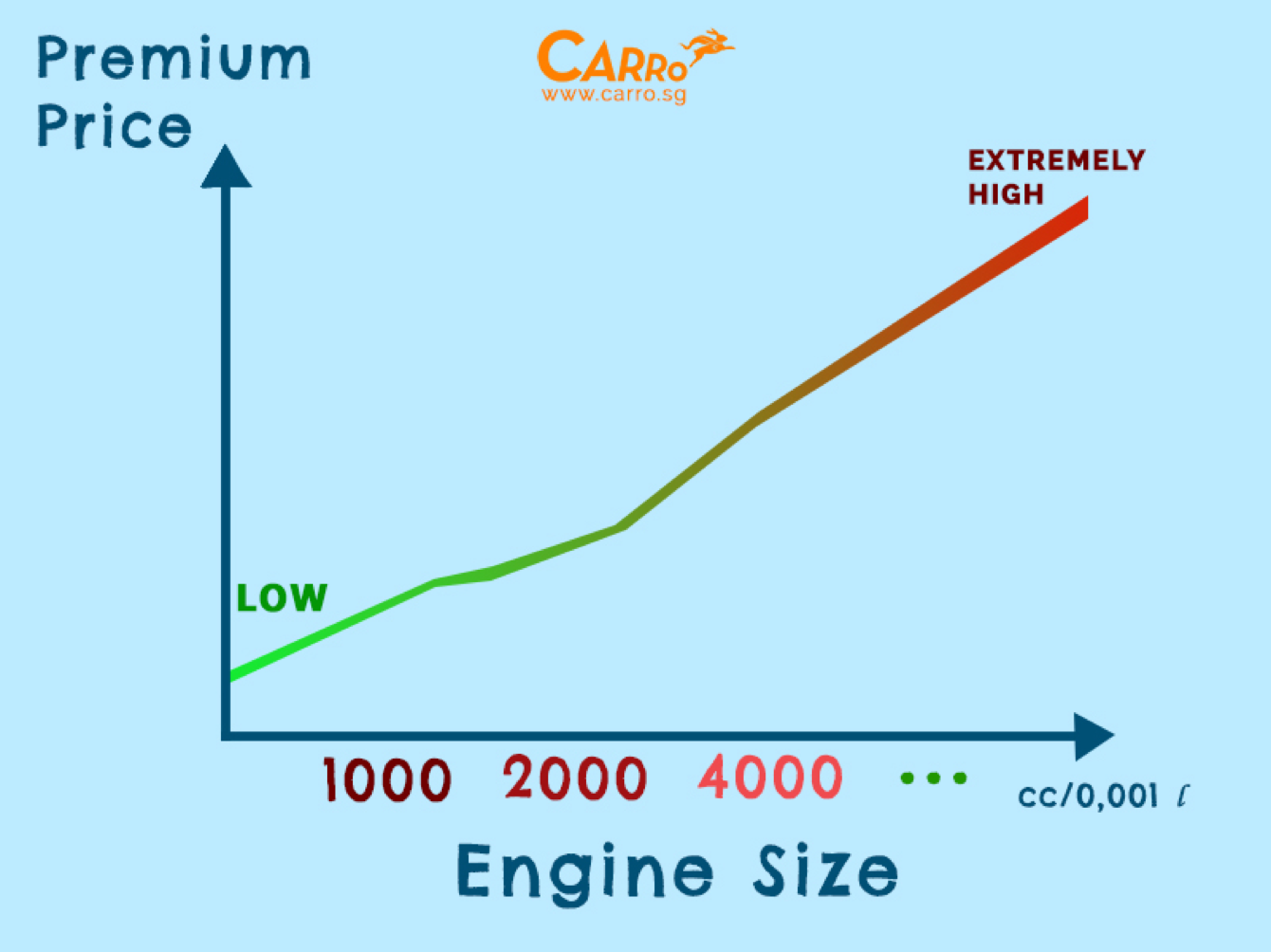

7. Engine Capacity (cc)

This depends on your car’s engine capacity. The larger your cc, the higher your car premium is. This should come naturally as the larger cc, the higher maintenance cost it would be (also, more problem you probably get).

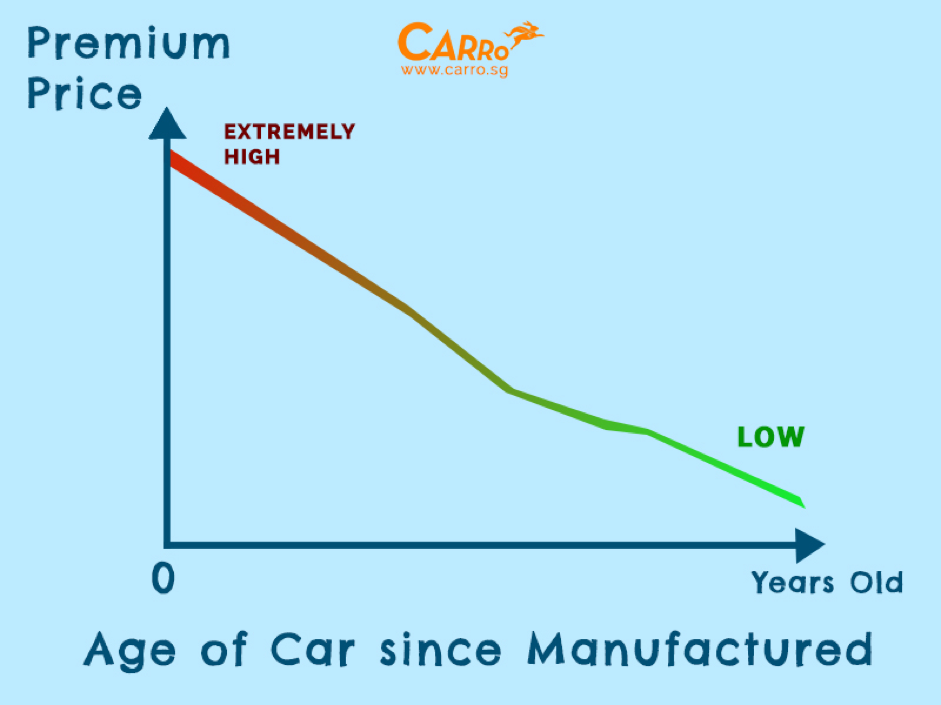

8. Year of Manufacture

The year of manufacture will affect the probability of your car being damaged internally (eg. Machine, Battery, etc.), externally (scratches) and even the probability of your car to be stolen. Older machines would pose more problems due to the harsh condition that the car has gone through. However, the price of repairs could be lower for newer cars as newer cars would have more expensive spare parts (due to the rarity at that specifically given point of time) and hence the workshop repair cost. Newer cars would also pose more risk of being stolen. Hence, it is normal for newer cars to have higher insurance.

9. Car Types

This depends on your car types: family, SUV, MPV, Sedan, Sports, etc. If your car has a higher possibility of incurring an accident, the premium price you pay is likely to be higher. For example, sports cars that have the ability to drive at high speeds are likely to face a higher premium as they have a higher chance of getting into road accidents.

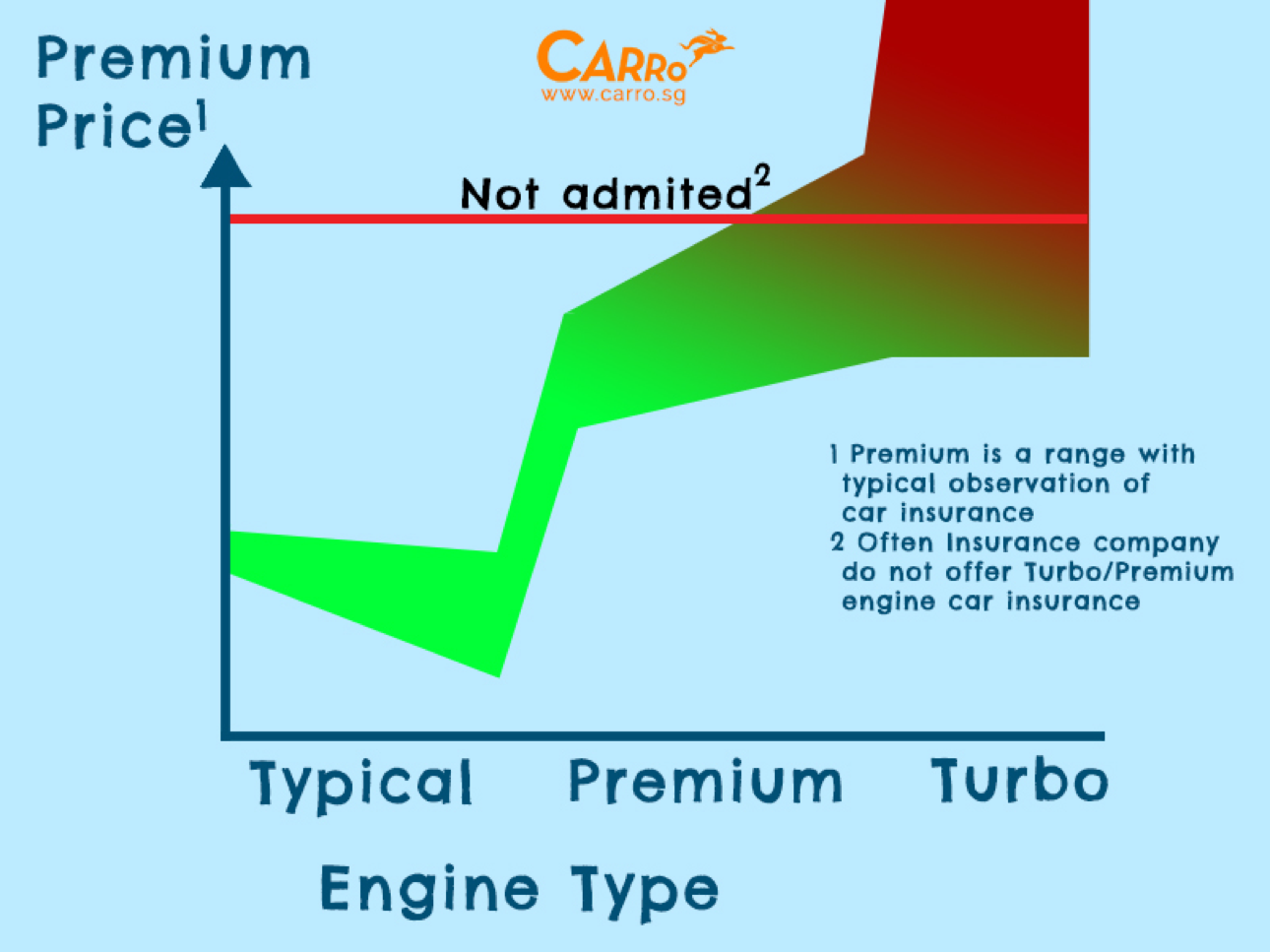

10. Engine Types

According to our resource, many companies do not insure cars with turbo/premium engine due to its high cost of maintenance and the problems the engines are likely to face.

11. Other Discounts

Some companies allow further discount based on the type of the car (Eg. Off peak cars, brands association etc.)

Looking for the best car insurance deals? Check out our sister company, Genie Financial Services! Genie offers a hassle-free digital experience that lets you choose from a comprehensive list of trusted insurers. Enjoy a fast and easy process with full paperwork settlement today!

People also liked: 10 THINGS YOU MUST KNOW BEFORE YOU RENEW YOUR COE DRIVING YOUR WAY TO LOWER MAINTENANCE COSTS HOW TO PROTECT YOUR CAR FROM FLASH FLOODS