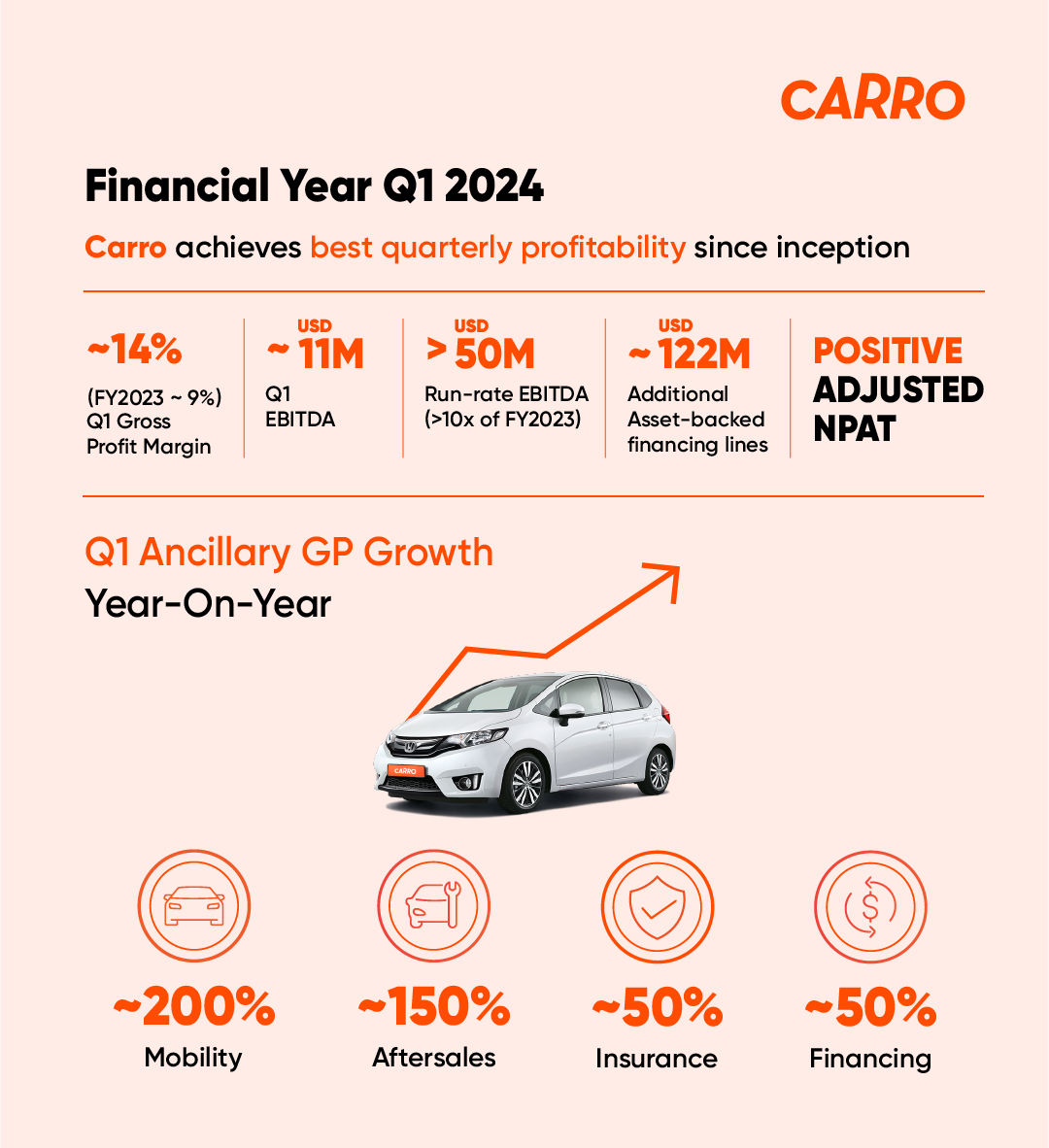

Carro achieves best quarterly profitability since inception in Q1 FY2024

- Gross Profit Margins rises to 14%

- Record EBITDA of US$11 million

- Run-rate EBITDA of over US$50 million

- Adjusted Net Profit After Tax (NPAT) positive

- Additional US$122 million secured in asset-backed financing lines

Singapore, 10 August 2023 – Carro, Southeast Asia’s largest and most profitable online used car platform, has clocked its highest EBITDA of over US$4 million for the month of June. The company also exceeded profitability targets for Q1 FY2024, despite a seasonally weaker quarter given the Hari Raya, Lebaran and Songkran holidays across the region.

Carro’s Q1 FY2024 Gross Profit Margins increased to 14%, well-ahead of FY2023’s Gross Profit Margins of 9%. EBITDA is now at an annualised run-rate of over US$50 million, more than 10 times of what it achieved for the entire FY2023.

Aaron Tan, co-founder and CEO of Carro says, “Our focus on fundamentals and our reluctance to enter into subsidy wars has enabled us to deliver four quarters of positive EBITDA. The strong execution of our digital ecosystem-led business model has made our business fundamentally stronger and more resilient, with significant ‘sticky’ recurring ancillary income streams. Ancillary attachment rates are going up as we focus more on our platform flywheel. The investment from Jardine C&C will help us drive even more earnings growth, particularly from aftersales. Our insure-tech partnerships with ZA Tech and MSIG are bearing fruits, with Gross Written Premium growing nearly 100% year-over-year.”

Carro earlier announced plans to enter into Japan and other markets. Aaron adds, “With strong cash flows and no operational burn, we made a strategic decision to expand into new markets this year – this will ensure stronger growth for Carro in the years ahead.”

Ernest Chew, Chief Financial Officer of Carro says, “Carro has bucked the industry trend and performed well in the first quarter with profitability metrics up across the board. Our first quarter EBITDA is already more than 3 times of our entire last financial year and we continue to be EBITDA positive in all core markets. Ancillaries continue to represent nearly 60% of our gross profit, so we’re under no pressure to sell more just to meet profitability targets. Our marketplace business, which contributes nearly 85% of our revenues, has doubled gross profit margins over the last 12 months. Gross profit for mobility grew nearly 200%, aftersales grew over 150%, whilst financing and insurance grew about 50% each year-over-year. We expect explosive earnings growth in the near term. We are one of very few profitable tech start-ups, not just in Asia, but globally as well.