All That You Should Know About Car Tax Incentives in Singapore

The car tax incentives in Singapore are instituted for the consequent environmental benefits while also ensuring affordable ownership of cars by the citizens. The car tax incentives in Singapore include the use of the Preferential Additional Registration Fee (PARF), the Certificate of Entitlement (COE), Green Vehicle Rebates, Off Peak Car and Carbon Emission-based Vehicles Scheme (CEVS) Rebates.

1) PARF Rebates

The PARF rebate considers the age of the car at deregistration. This rebate applies to registered owners of vehicles which have been deregistered after ten years from their first registration date. The earliest registration date for the vehicle (locally or internationally) is considered in determining the age of the car. The PARF rebates are utilized in offsetting the registration fee, additional registration fee, the Quota Premium or the additional charges accorded to the registered owners of the vehicles. To qualify for the PARF rebates, the vehicle should not exceed a certain number of years (depending on the registration scheme) at the time of the de-registration. For example, a private/off-peak/company car should not be more than 10 years old while taxis should not exceed 7 years old. The vehicle should have been licensed for the period preceding the de-registration date. Furthermore, the vehicle should have been new at the time of the first registration in Singapore. In the case of imported used cars, they should be registered in Singapore on or after 1st September 2007.

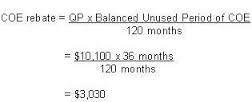

2) COE Rebates

The COE rebate applies to cars that have been de-registered before the end of its COE. The COE rebate considers the Quota Premium (QP) paid by the registered owner and the period remaining before the expiry of the vehicle’s COE. The PARF and COE rebates are valid for a period of 12 months from the date of de-registration. Any excess amount of the PARF/COE rebate unused will be forfeited. However, registered owners qualifying for the PARF/COE rebate have the option to encash the PARF/COE rebate in case they intend on not using them. The encashment option makes it easier for car owners to surrender their vehicles and switch to the use of public transport. This is in line with Singapore’s efforts of making public transport the preferable option for all its citizens.

Find out how to easily attain your PARF or COE rebate in this short article.

3) Off-peak car rebates

The car tax incentives are also based on the ownership and the type of vehicle. The cars provided by employers and those acquired for private benefits receive different tax treatments in Singapore, for example, the car-related benefits of the company car are taxable while the car-related benefits for private cars are not taxable. The taxable value of the car and the car-related benefits for the company cars is higher compared to the private cars.

4) Green vehicle rebates

Considering the type of vehicles, the green vehicles enjoy additional benefits relating to the tax incentives. The registered owners of green vehicles are entitled to rebates of the additional registration fee (ARF), unlike the cars with high carbon emissions which face the full corresponding ARF surcharge. The set ARF surcharge in Singapore is 100% and 15% of the open market values (OMV) for cars and motorcycles respectively. Also, the green vehicles incur lower Road Tax charges compared to the vehicles with high carbon emissions. Diesel cars (having high carbon emission level) are subjected to additional tax charges, the Special Tax. The green vehicles are not subject to the Special Tax. The Compressed Natural Gas (CNG), Petrol-CNG and the Electric or Petro-Electric cars are no longer subject to the Special Tax.