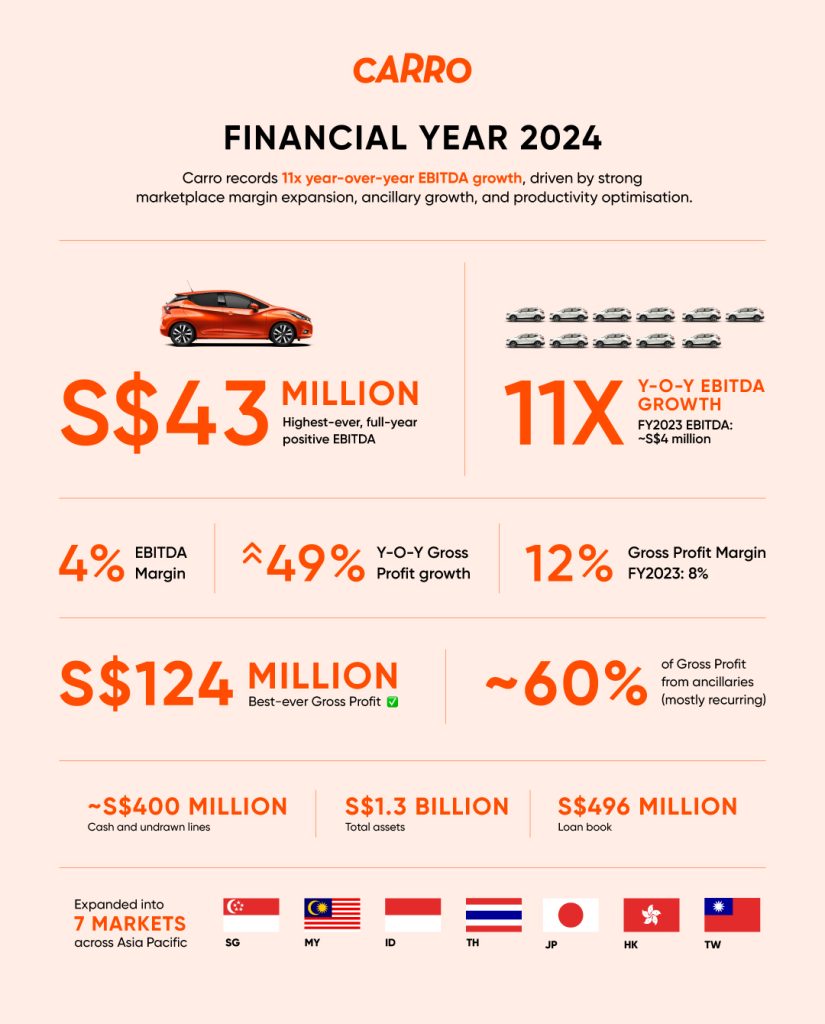

Carro receives strategic investment from Woori, capping off a record FY2024 with 11x year-over-year EBITDA growth

- Strategic investment marks Woori Venture Partners’ first late-stage deal in Southeast Asia, to form a closer partnership as Carro ramps up expansion plans across Southeast Asia, including Indonesia

- Best-ever EBITDA of S$43 million (US$32 million), the fourth year of positive EBITDA

- Best-ever Gross Profit of S$124 million (US$92 million), a 49% year-over-year growth

- Gross Profit Margin (GPM) improved to 12% compared to 8% in FY2023, underpinned by nearly 60% of Gross Profit from ancillaries

- Total assets increased by 15% year-over-year to S$1.3 billion (US$0.9 billion)

Singapore, 10 December 2024 – Carro, Asia Pacific’s largest and fastest-growing online used car platform, is ending the year strong, having achieved an EBITDA of S$43 million (US$32 million) and a 4% EBITDA margin, according to their audited FY2024 numbers.

FY2024’s GPM expanded to 12%, shored up by a combination of strong marketplace margin expansion, ecosystem-led ancillary income growth, and productivity optimisation.

Carro’s fintech business, Genie Financial Services, recorded prudent growth across the region and kept non-performing loans (NPL) at below 0.5%, which is much better than industry benchmarks. The overall loan book grew to S$496 million (US$370 million).

In the last 12 months, Carro expanded its geographic presence to seven markets, out of Southeast Asia to Hong Kong and Japan.

Aaron Tan, co-founder and Group CEO of Carro says, “These numbers underscore the unique differentiated benefits of our ecosystem-led business operating model, as we focus on driving marketplace margin expansion by cross-selling ancillaries to drive recurring income streams. Even as we grow our volumes at double digit percentage to a record, we have and will continue to be laser focused on improving profitability, customer lifetime value across our ecosystem, inventory turnaround speed and productivity. This means building and leveraging more data and technology, including AI and machine learning. We are better placed than ever to scale sustainably and profitably in our core markets and are very excited to grow our newest markets: Hong Kong and Japan. We are still small in an enormous but fragmented market, there is significant room for growth as we build our business for scalability and sustainability.”

Ernest Chew, Chief Financial Officer of Carro says “We are heartened and proud to have over-delivered on our initial target of a 10x EBITDA growth. Despite a challenging macro-environment, we achieved significantly improved margins across most profitability metrics last year. Our focus on quality of revenues and recurring earnings have resulted in a 92% reduction in reported operating loss and within a striking distance of positive operating profits. Even as our cash from operating activities swung to positive, we continue to be extremely vigilant on liquidity and have built up a warchest of over S$400 million in cash and undrawn lines. We have also been disciplined around managing down costs, improving efficiencies and pushing digital transformations to drive strong earnings growth.”

In a year marked by partnerships, Carro received strategic investments from Jardines and launched “Carro Care Powered by Jardine & Cycle”, Carro’s in-house refurbishment and after-sales servicing capabilities. It received a strategic investment from DRB-Hicom to support its Malaysian fintech business, which has seen solid growth. Carro also strengthened its insuretech offerings by working with ZA Tech to distribute highly personalised self-serve insurance products online, leading to an explosive Gross Written Premium growth of over 60%.

Via its latest strategic investment from Woori Venture Partners, Carro aims to grow further in its Southeast Asian markets, especially in Indonesia where Woori has a strong presence in. Indonesia used car market size is estimated at US$56.3 billion in 2024, and is expected to reach US$74.4 billion by 2029, according to a study by Mordor Intelligence. Bolstered by a robust, growing economy, more and more Indonesians are primed to be car owners, yet a lack of affordable financing has deterred even upper class households from owning cars.

Alan Ang, Director of Woori Venture Partners says, “Carro is the clear leader in a space that is prime for disruption, with significant room for expansive growth. Their ability to grow profitably at scale is testament to their performance and commitment. Woori Venture Partners continues to be a global venture capital leader by backing outstanding founders and sustainable businesses anywhere in the world with our investment in Carro. We are very pleased to be a strategic partner of Carro and help Carro reach its next stage of growth.”

Ernest Chew, Chief Financial Officer of Carro says, “It’s always been a priority for Carro to build powerful partnerships with banks and financial institutions. Receiving a strategic investment from Woori Venture Partners, a venture capital subsidiary of Woori Financial Holdings – a storied Korean financial institution – is a ringing endorsement of our ecosystem-led and complementary fintech business model. We look forward to working with Woori to plug the gaps in the market, serve the underserved better and drive financial inclusion.”